Rutland Partners, the specialist turnaround and restructuring investor, is pleased to announce the conditional sale of Attends Healthcare Group to Domtar Corporation for an enterprise value of €180 million. The transaction is conditional only on customary regulatory clearances and is expected to complete in late February.

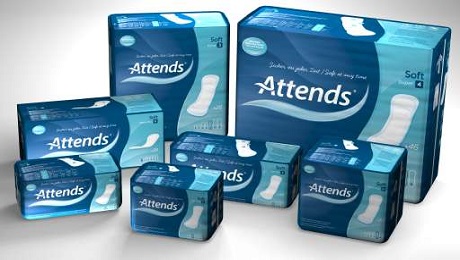

Rutland acquired Attends, a European leader in branded and own label incontinence products, from 3i in July 2007 for €93.5 million and has invested over €25 million in support of management’s plan to restructure operations and develop the product portfolio. Products are manufactured in Aneby, Sweden and supplied across Northern and Western Europe through a mix of reimbursement, retail and contract channels.

The manufacturing plant has been developed into a world class facility with eight high speed production lines and a much reduced cost base whilst the majority of the product portfolio has also been repositioned over the last two years to better address growth areas of the market.

As a result of the restructuring since 2007, Attends has grown sales to a current run rate in excess of €140 million and grown EBITDA by 45% to a current run rate of approximately €23 million. Reflecting this growth and the strong platform for European expansion that Attends offers, Domtar’s purchase price represents approximately eight times run rate earnings and generates a cash multiple of 3.3times Rutland’s original investment. The new owners are retaining the existing management led by James Steele (Chief Executive) and aim to double earnings over the next five years from strong growth in the incontinence market.

Attends Healthcare is the first disposal from Rutland Fund II (£320 million) which to date has made six investments (including Attends). Recent acquisitions have included Brandon Hire, a leading tool and equipment hire business with a national network of depots, GEMS International, a world leading subsea technical analysis and surveying business acquired in March 2011, and Laidlaw Interiors Group, a leading commercial interiors manufacturing and distribution group, acquired in August 2011.

Commenting on the deal, Nick Morrill, Managing Partner of Rutland, said:

“This deal is a prime example of Rutland’s investment strategy and is a great outcome for both our fund investors and Attends’ management. Domtar’s approach and valuation have recognised the excellent performance of the business following its extensive operational restructuring. They are acquiring a strong brand and a business with significant potential in a growing market. We wish Domtar and management every success for the future.”

Commenting on the deal, James Steele, Chief Executive of Attends, said:

“Attends was a strong brand and prominent player in the European adult incontinence market but, with the benefit of Rutland’s investment and support, it now enjoys a leading position in this growing sector. We have enjoyed the period of Rutland’s ownership and are excited by Domtar’s plans for the business. We look forward to working with them to develop the business further in its markets.”

The transaction was led on behalf of Rutland by Nick Morrill and Oliver Jones with support from Kajen Mohanadas. PricewaterhouseCoopers provided financial advice and Taylor Wessing acted as legal advisers.