14 Aug 2019 Rutland Exits AFI Group

Rutland Partners is pleased to announce that on 13 August 2019 it agreed and completed the sale of AFI Group (“AFI”) to its existing management team led by CEO, David McNicholas, and Chairman, David Shipman.

At the same time AFI has acquired Facelift, a long-established powered access rental business with a strong heritage in the truck mounted platform market. The combined deal represents a value of c.£160m and has delivered a successful exit for Rutland.

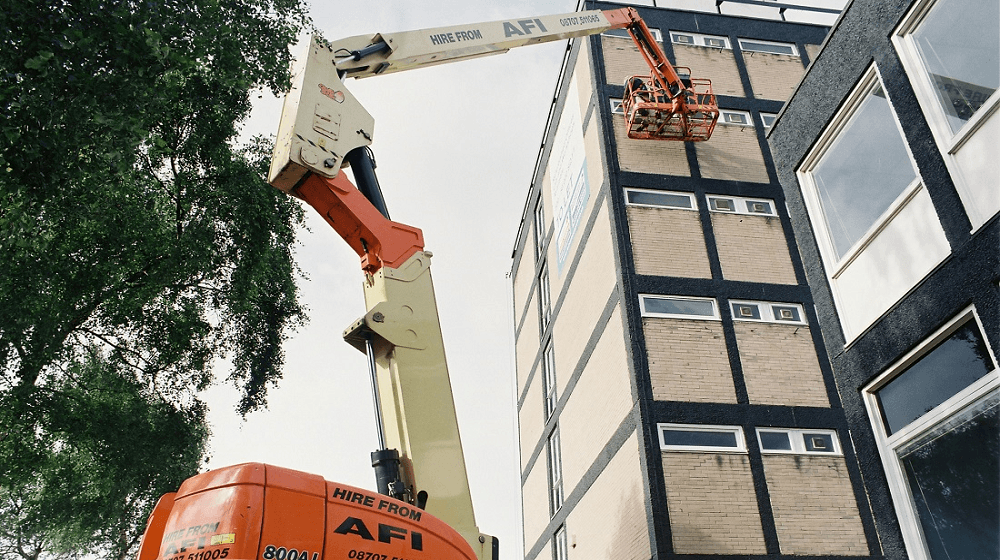

AFI is one of the UK and Middle East’s leading powered access specialists offering machine rental and sales as well as industry accredited training and health & safety course. Rutland invested in AFI in May 2013 in a transformational and complex three business combination deal for a value of c.£85m. Since then, AFI has completed several further bolt-on transactions, opened new depots in both the UK and Middle East, and broadened its service offering resulting in revenue increasing from c.£50m at acquisition to over £100m today.

Post-completion, AFI will be majority owned and run by its existing management team with financial support from existing bankers PNC and £60m of new funding from Pricoa Private Capital.

The investment was led on behalf of Rutland by Oliver Jones, David Wardrop and Kajen Mohanadas.

Oliver Jones, Partner at Rutland, said: “We have enjoyed a successful relationship with the team at AFI over the past six years and are pleased that we have been able to support the business to double in size, and broaden its service offering and geographic footprint since our original investment. We wish David and his team all the best for the future.”

David McNicholas, CEO of AFI, said: “We are hugely grateful for the support and advice from Rutland, which has allowed us to achieve a significant amount over the last six years. Their experience in complex situations was invaluable to help deliver the 2013 deal, and they have supported us significantly since then to grow and develop AFI. We now look forward to the next stage of AFI’s development with confidence.”

The sale of AFI represents the exit of the final unrealised investment in Rutland Fund II, and follows last week’s announcement of Fund III’s investment in Hereford Contract Canning (HCC) Limited.

AFI Project Story